Wike Charges Commission On New Tax Culture In Rivers

The governor of Rivers State, Chief Nyesom Ezenwo Wike, has charged members of the state’s Tax Appeal Commission to ensure, without hesitation, a new culture in which taxable persons and entities will comply with the relevant tax laws in the state.

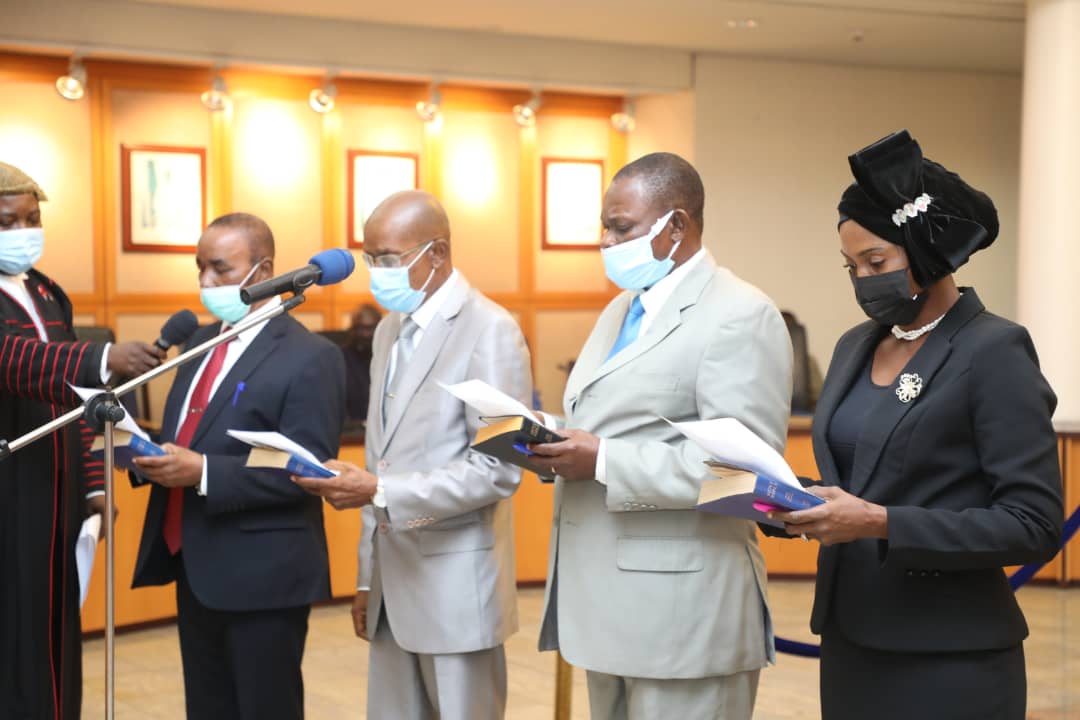

As contained in a release by his media aide, Kelvin Ebiri, the governor gave the charge shortly after swearing-in a four-member Body of Tax Appeal Commissioners at Government House, Port Harcourt, today.

The tax commissioners sworn-in by Governor Wike included Justice Bennett Eke Ugbari (rtd), who will serve as the chairman, Edwin Krukrubo, Owhonda Ihekwoaba Nobel and Mrs Gift Sovins.

Governor Wike admonished the commissioners to focus on dealing with complaints arising from those who do not want to pay their taxes, while also prevailing on those who believe that the tax body is doing what it is not supposed to do.

The governor said taxes are important sources of revenues for any government to shore up its needs for fund to implement its development agenda.

“It is a very serious assignment at this period as regards to what is going on. So, I believe that you have to take this assignment as a call of duty from your state.

“No country can survive without taxes. And so, you will do all you can to support the government and the citizens to do what they are supposed to do.

“I have confidence in you, the chairman, that you will be able to lead the members of the commission to do the right thing,” Governor Wike said.

Responding, chairman of the Rivers State Body of Tax Appeal Commissioners, Justice Bennett Eke Ugbari (rtd), said the state, like other federating states, needs to generate sufficient internal revenues to augment the statutory allocations it receives from the Federal Government.

Doing this, he said, will enable the government to fulfil its obligations and promises to the people in terms of infrastructure and other development, as witnessed presently in the state.

“It is, therefore, the intendment of the commission to partner with other relevant tax authorities in Rivers State to generate adequate internal revenue for the state.

“In carrying out our assignment, the commission shall be guided by the principle of fair hearing, justice and equity. We shall ensure that there is proper assessment of taxes and that every tax payers in Rivers State pays adequate tax as required by the relevant tax laws,” he said.

Justice Ugbari (rtd) assured that the commission will discharge its responsibilities diligently and conscientiously with the fear of God, assuring that members would also work in accordance with the objectives, purpose of the enabling law and other tax laws of Rivers State.