The propriety or otherwise of the decision of the President Bola Tinubu-Federal Government to implement five per cent Petroleum Products Tax has continued to generate controversies, being the major issue of discourse in the polity. While the government has not disclosed the scheduled date, its implementation appears sacrosanct, taking effect from 2026.

Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, speaking at a press briefing in Abuja, last Wednesday, said the Federal Government has no immediate plan to implement the five per cent Petroleum Products Tax, as contained in the Tax Administration Act, 2025.

The planned implementation of the five per cent Petroleum Products Tax has generated wide-spread worries and anger among Nigerians, with organised labour giving the government an ultimate to step it down or face an industrial action.

Hapless Nigerians, in their millions, are bemoaning their lot, bearing the weight and burden of various taxation under President Tinubu who, in his inaugural speech, on 29 May, 2023, had told us that the the road and path to national growth and development is laced with thorns, broken bottles, nails, blades and other sharp objects.

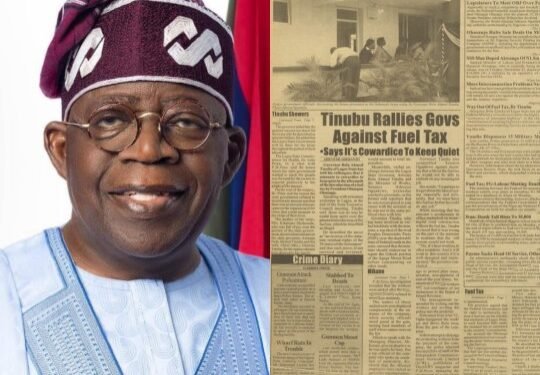

While the controversy rages, in the face of pervading economic hardships, Nigerians need to know that President Tinubu, who had been at the forefront of agitations against anti-people policies, may have been absolute and resolute to go ahead and implement the five per cent Petroleum Tax.

Refreshing Our Memory…

While Nigerians have largely chosen to remain passive, bearing the burden of tax and taxation with a stoic silence, it will be apt to go down the memory lane and refreshen our memory of the position of the president on the same decision taken by one of his predecessors.

Like the controversial removal of fuel subsidy -and whose positive impacts are yet to be felt – President Tinubu was, once, at the forefront of the agitations against the plan by the then Peoples Democratic Party (PDP)-Federal Government to introduce a similar policy namely, the implementation of ₦1.50k fuel tax.

Tinubu, as the governor of Lagos State in 2003, was defiant in his opposition to the plan by the President Olusegun administration to introduce the fuel tax in 2003.

Tinubu Rallies Govs Against Fuel Tax •Says It’s Cowardice To Keep Quiet

Governor Bola Ahmed Tinubu of Lagos State has told his colleagues that it amounts to cowardice to keep quiet in the aftermath of the introduction of a fuel tax by President Olusegun Obasanjo.

Speaking with newsmen yesterday in Lagos after the State Executive Council meeting, Tinubu said there is no way he could keep quiet over the planned introduction of the fuel tax, which he described as illegal.

He described the move as “an erosion of the residual statutory rights of the 36 states of the federation” and that move, if not resisted and reversed, would amount to total imperialism.

(Page 6, PM News: Tuesday, December 30, 2003.)

Ditto Vanguard Newspaper (cited in PM News, op.cit)

Way Out Of Fuel Tax, By Tinubu

President Bola Ahmed Tinubu of Lagos State has advised the Federal Ministry of Works to explore the highly lucrative “economics of interstate highway” in the challenge of rehabilitation of existing highways and new ones, rather than insistence on imposing fuel tax as a means of achieving this aim.

And When Labour Union Was Really A Bulldog…

And When Labour Union Was Really A Bulldog…

To all intents and purposes, the various labour unions we have in contemporary Nigeria have sadly become toothless bulldogs that can only bark, but cannot bite. Gone were those days when the leadership of Labour Unions were up and doing, fighting for the interest and welfare of the common man.

Businessman and renowned journalist, Mogaji Wole Arisekola, succinctly put the Labour Unions’ leadership in a proper perspective in an opinion article, titled “From Abacha To Dangote: How NUPENG Fell From Lion’s Roar To Whisper Of Greed”

The publisher of Street Journal magazine lamented thus: “Slowly, the lion’s roar changed. By the early 2000s, strikes were no longer about democracy. They were about money, perks, and political favours.

Some union leaders crept into politicians’ homes in the dead of night — not to demand justice, but to secure personal deals. Their children no longer schooled in Nigeria. And when former NUPENG leaders threatened to reveal the list of politicians with kids studying abroad, some politicians laughed and replied: “We also have dirt on you…

“…In 1994, NUPENG risked everything for democracy. In 2025, they risked Nigeria’s stability over membership cards. The lion has become a petty gatekeeper, snarling not for the people — but for its own feeding trough…”

But this has never really been the case with the Organised Labour, even in the present democratic dispensation. There were several reports of Labour-Government showdowns, with the Unions always fighting on the side of the people.

An attestation to the people-oriented posture of the Organised Labour then was the fact that the Federal Government, then led by Obasanjo, dropped the idea of the implementing the proposed ₦1.50k fuel tax., among some other contending issues then….

Fuel Tax: FG-Labour Meeting Deadlocked (The Punch, cited in PM News, op.cit).

The meeting between the Federal Government and oil workers’ union over plans to introduce ₦1.50k fuel tax ended in a deadlock in Abuja, on Monday.

Sources close to the meeting, however, disclosed to our correspondents that the Federal Government agreed to put the privatisation of the Nigerian Petroleum Corporation (NNPC) on hold for another six months.

What Has Changed Between 2003 and 2025

As the country and its people look forward to the eventual implementation of the five per cent Petroleum Products Tax, here are some salient questions, begging for answers, and our dear President Bola Tinubu, you are in the right position to answer them: At what point did you come to realise that the hapless Nigerians should be made to bear the brunts of your various economic policies? Why did you drop your anti-imperialism posture, as reflected in your stance against the ₦1.50k fuel tax proposal by Obasanjo?

Your Excellency sir, you once described the ₦1.50k fuel tax as “an erosion of the residual statutory rights of the 36 states of the federation”, adding that its implementation would mean a degeneration to total imperialism.

Arguably, the decision to implement the five per cent Petroleum Products Tax, as contained in the Tax Administration Act, 2025, was taken without the input of any governors of the 36 federating units.

But, has the 1999 Constitution of Nigeria (as amended) altered to take away the “residual statutory rights of the 36 states of the federation”? Sir, with a benefit of hindsight, will you accept that the planned implementation of the five per cent Petroleum Products Tax was a negation of your earlier position (as the governor of Lagos State in 2003) against total imperialism?

Nigerians are already groaning under the heavy economic and financial yokes, the reverberating effects of the oil subsidy removal. It will not be proper to increase their hardships with the five per cent Petroleum Products Tax, even as they are anticipating yet, another heavily-laddened personal income tax, all in 2026.

Mr President sir, yes, and agreed, there must be reforms and sacrifices, but must such come at a higher cost? Let your fiscal and economic policies wear the toga of humanity- the people should be the ultimate beneficiaries of these policies in the race towards greater national socio-economic growth and infrastructural development. The five per cent Petroleum Products Tax, as it is with the case of the oil subsidy, may not bring any mutual benefits to the Nigerian masses.

•Falade is the CEO/Editor-in-Chief, Newscoven.com