The Oyo State government has said small and medium-scale businesses, artisans and farmers would benefit from another ₦5.4 billion Sustainable Actions for Economic Recovery (SAfER) package.

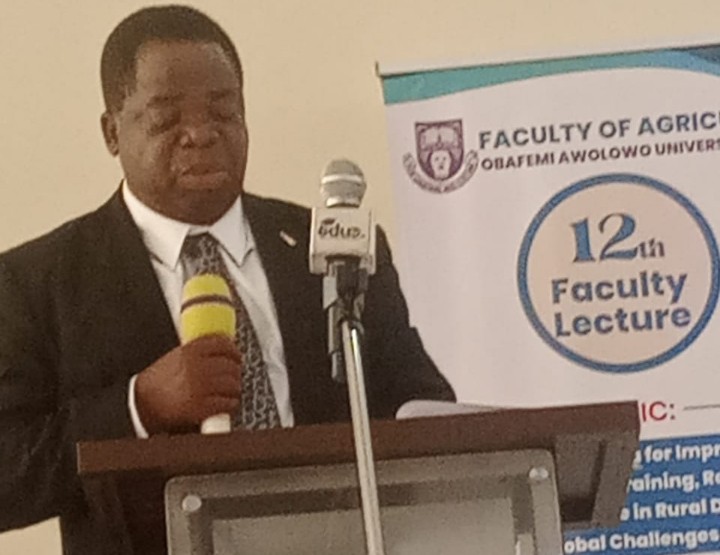

The state Commissioner for Budget and Economic Planning, Professor Musibau Babatunde, said this at the presentation of the report of the implementation of Quarters 1 and 2 of the 2025 Budget, on Monday.

He said the state government would soon begin the implementation of another phase of SAfER with about ₦5.4 billion earmarked to support small and medium scale businesses, farmers, and operators in the transportation and healthcare sectors.

“In the area of the welfare of the people, this has been improving and I can tell you that another phase of SAfER is going to come up very soon. About ₦5.4 billion has been earmarked.

“It is going to be deployed towards supporting small and medium enterprises, farmers with focus on livestock, fishery, poultry and crop production in the state as well as transportation and healthcare systems.

“We believe that implementing this will further improve the lives of the residents of the state,” the commissioner said.

The commissioner, presenting the revenue and expenditure performance, said the state achieved 80 per cent revenue for the half-year budget performance between January and June.

He noted that the presentation of the budget performance provided a feedback mechanism on the challenges and opportunities of the budget.

He added that it was also a chance to assess the 2025 Budget implementation across the various ministries, agencies and departments (MDAs).

According to Babatunde, the 2025 Budget, tagged “Budget of Stabilisation”, had stakeholders’ participation across the seven geopolitical zones of the state to ensure inclusiveness and citizens-nominated projects.

He added that Governor ‘Seyi Makinde approved a quarterly performance review of the budget, reflecting his administration’s commitment to openness and transparency in the budget process.

The commissioner noted that the governor also granted the request of Civil Society Organisations (CSOs) and other stakeholders to participate in the budget process beyond the point of preparation.

This, Babatunde said, was done by approving an engagement with major stakeholders so that they could see what the government has been able to achieve and the challenges it was facing.

He said the revenue performance of the budget stood at 80 per cent pro rata, while expenditure performance had reached around 69 per cent of expenditure pro rata.

“At the last stakeholders’ budget meeting in 2024 held ahead of the 2025 budget preparation, we had a request from the CSOs that it should not just be at the point of preparing for the budget that they would have inputs, they also want feedback on the budget performance across the various quarters of the implementation of the budget.

“So, the governor graciously approved that we should be doing a quarterly performance review of the budget implementation and also engage with all the major stakeholders that were actually brought in at the point of preparing for the budget.

“This is to ensure that they can see the revenue and expenditure; what we have been able to achieve and the challenges we are facing.

“We should be able to tell them what are the opportunities we have created as well as get their inputs, because we have citizen-nominated budgets in the current budget that we are trying to implement.

“If you don’t forget, the stakeholders’ Town Hall meeting is meant to be a bottom-up approach and all the other set of roadmaps, long-term relevant agenda and our own plan are supposed to be the top-down approach.

“The point in which resources actually allowed us is what we have been able to finalise as a project.

“So, we need to provide the feedback to all the stakeholders to say that this is what we have been able to achieve in terms of our revenue expenditure and pro rata in terms of what we have been able to do.

“Revenue, at the moment, is around 80 per cent for revenue pro rata in terms of parts. If you put the budget into the half year, we have done Quarter 1 and quarter 2; we have been able to achieve about 80 per cent revenue.

“And, also in terms of expenditure, we have been able to do around 69 per cent of expenditure pro rata too. This shows the fact that the outlook is quite interesting.

“This actually basically doesn’t even include some of the approvals that the governor has given, but those ones will be covered and captured in Quarter 3 of the 2025 budget implementation,” he said.

Responding to a question on the increase in revenues that have accrued to the state, Babatunde said it was important to consider the general equilibrium rather than a partial one.

He noted that, while there have been increases in Federal Allocations and internally generated revenue (IGR), the state’s expenditures have also gone up as a result of the minimum wage increase, mass recruitment of teachers, civil servants and health workers as well as the rising inflation cost in the country.

He said the state’s budget outlook was good, adding that the increase in revenue has also culminated into increased spending aimed at improving the welfare of the residents of the state.

“Definitely, it is a huge opportunity for us to implement the budget but don’t also forget the fact that, while FAAC and IGR have gone up, we have some other expenditures of the state that have also gone up

“Take, for example, the ₦80,000 minimum wage and consequential adjustments. We have also been able to put some welfare measures for transportation in the state, among other interventions.

“We recruited more teachers and more civil servants for the efficiency of service delivery in the state. So, when you consider one aspect, that is a partial equilibrium and people actually don’t consider the second aspect.

“So, we have to look at the general equilibrium; what has actually come in and what again demands immediate response of expenditure that we also need to take into consideration.

“So, it is not just the fact that FAAC and IGR have increased. Our expenditure towards improving the welfare of the citizens of our state has also increased.

“Security issues have actually been well-maintained and the agriculture sector is booming because farmers are able to go to their farms and become more productive.

“We are enhancing the roads framework, especially the rural roads under the RAAMP Programme. So, this has actually given us more opportunities than challenges in terms of being able to implement the laudable roads.

“Let me also say that the tax net has been widened enough to actually bring in more revenue, because people that are supposed to pay taxes are actually being made to pay,” the commissioner added.