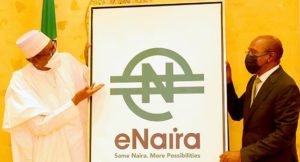

e-Naira: Top 3 Features Nigerians Should Know

It is no longer news that President Muhammadu Buhari, on Monday, launched Nigeria’s digital currency, e-Naira, at the Presidential Villa, Abuja.

However, the digital currency came with three top features which Nigerians should know and understand in the course of financial transactions,using e-Naira.

The three top features that came with the e-Naira wallet include general payment system; good for individual and corporate business transactions; and it would allow a secured banking experience.

Announcing the launch of the digital currency, Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, said the currency would advance the boundaries of payments system in Nigeria and also make financial transactions easier.

The currency was scheduled to be unveiled on October 1, but was postponed due to other activities slated for the Independence Day celebration.

General Payment System

Nigerians can move money from their Nigerian bank accounts to their e-Naira wallet with ease. They can also make in-store payment, using their e-Naira wallet by scanning QR codes.

Individuals can monitor their e-Naira wallet, check balances and view transaction history with ease and the platform allows users to send money to one another through a linked bank account or card.

According to the CBN, the objective is to see e-Naira enable households and businesses to make fast, efficient, and reliable payments, while benefiting from a resilient, innovative, inclusive, and competitive payment system

“The cost of sending and receiving money faster, easily, will come at a very minimal costs”, the CBN promises.

For individuals and businesses

The introduction of the digital currency give easy access to transactions for both the private sector, large-scale business and individuals.

e-Naira offers local and international non-governmental organidations and religious institutions money transaction solutions that ensures that, at the end of the day, their focus is trained more on carrying out their projects than on the security and usage of the money backing each project.

It also offers donation features which allows organisations to seek for donations, while e-Naira is expected to make expense-tracking and report-development for social projects for NGOs, nearly automated.

This is as the traceability of each e-Naira transaction ensures that balancing ledgers and knowing the exact identity of the recipient of each e-Naira occurs at near-real time and in tandem with the very transfer of funds itself.

Secured banking experience

e-Naira offers diaspora payments which is expected to become cheaper and safer as to ensure individuals get more value for every Naira they earn.

People can boycott the queues and pay taxes, and bills from the comfort of their home in an easier and dependable fashion.

CBN assures that government financial aids will get straight to the people, as it knocks the middle men out the way and individuals can claim funds directly.

An extra benefit attached is the secure banking which the CBN assured the e-Naira promises.

•Sources: Channels TV, BBC